Claims Center

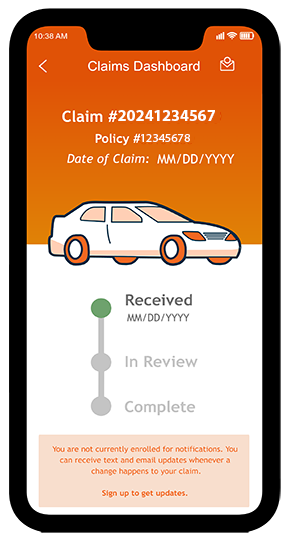

Log in to My Account to access your Claims Dashboard- a seamless feature to report and track your claim. Genuine care since 1899.

Our Claims Process

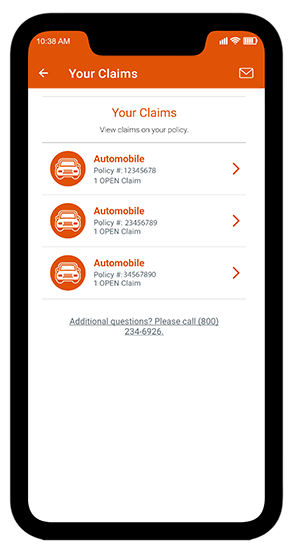

Manage Your Claim From Anywhere

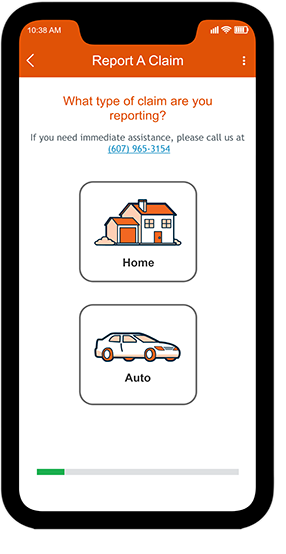

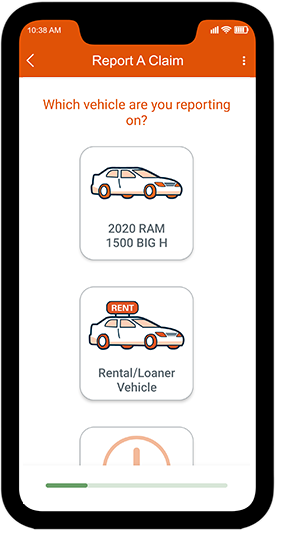

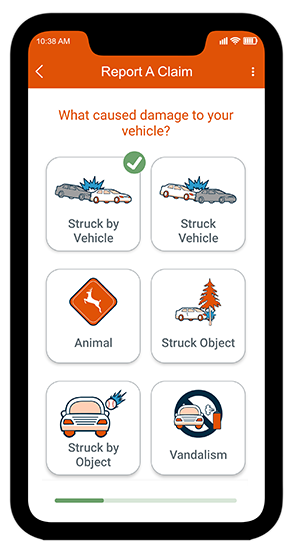

The NYCM Insurance Mobile App offers policy management at your fingertips—right on your phone!

- Report and track a claim

- Manage your policy information

- View your bill and manage payments

- Access your ID cards

Claims Resources

We're here to help.

For most claims, starting the process online is the recommended option. Start by reporting your claim online through My Account or on-the-go with our mobile app. If you're unable to report a claim digitally, please contact us via phone or live chat.

Have your policy number ready. You will be asked a few questions about the situation and prompted to provide supporting documentation such as police reports or receipts, if applicable.

If you’ve been in an accident, you can report your claim once you’re safe and have called the authorities. You do not need to wait for a police report. Do not make any repairs to your vehicle until we’ve had an opportunity to inspect the damage. If you’ve had damage to your property, avoid moving anything if possible until you’ve reported your claim and an adjuster reviews the damage. If you must move something to prevent further damage or injury, be sure to take photos.

You can check the status of your claim any time in the Claim Dashboard located within My Account online or in the NYCM Insurance Mobile App. If you need to make changes to your claim, you can request assistance through My Account or by calling a representative at 800-234-6926.

We recommend claims be paid electronically to expedite your payment. If we cannot pay your claim electronically, you will receive a paper check by mail.

Auto Claims

What happens after an auto accident?

The damages you can claim depends on the policy you purchased. A coverage guide for auto policies can be found on our website. For policy specifics, reach out to your insurance agent.

You can report your glass claim in My Account or through our trusted partner, Safelite Solutions.

To report your auto claim, you’ll need to provide details about what happened, a police report if you have one, and details of other parties involved.

NYCM Insurance can set up rental car reservations through Hertz or Enterprise Rent-A-Car. The bill can be sent directly to us to minimize your out-of-pocket costs. You can also request a rental via email or text using your Claim Dashboard. Wondering about insuring your rental car? Check out the resources tab of our website for more details!

You can use the repair shop of your choosing or we’re happy to help you find an in-network shop within our Advantage Repair Program. Learn more about our Advantage Repair Program or find a repair shop now.

Home Claims

What do I do after there is damage to my home or property?

Your coverage depends on your policy. A coverage guide for homeowner policies can be found on our website. For policy specifics, reach out to your insurance agent.

You will need to provide as many details as possible about what happened, your home inventory list, if you have one and any receipts and/or photos you may have.

You can download our home contents inventory worksheet on our website. Filling this out before a claim will help save you time after a loss. When you report a claim, you will need to submit a list of all your belongings that were damaged or lost.

Wright Flood claims can be reported to the flood agent listed on your declaration page or you may report it directly online . Please be sure to include your policy number and contact information where you can be reached.

We can’t say for sure until we know the details of your claim. Many homeowners policies do include damage to the property of others. For policy specifics, reach out to your insurance agent.

Still have specific claims questions? Visit our FAQ page >

Need to Report A Claim?

Start your claim by logging into My Account now.

Stay in the Know

Visit our blog for additional information on renters insurance, DIY hacks and insurance know-how: